An open access journal

An open access journal

Forecasting the NASDAQ Composite Index Using Artificial Neural Network

Abstract

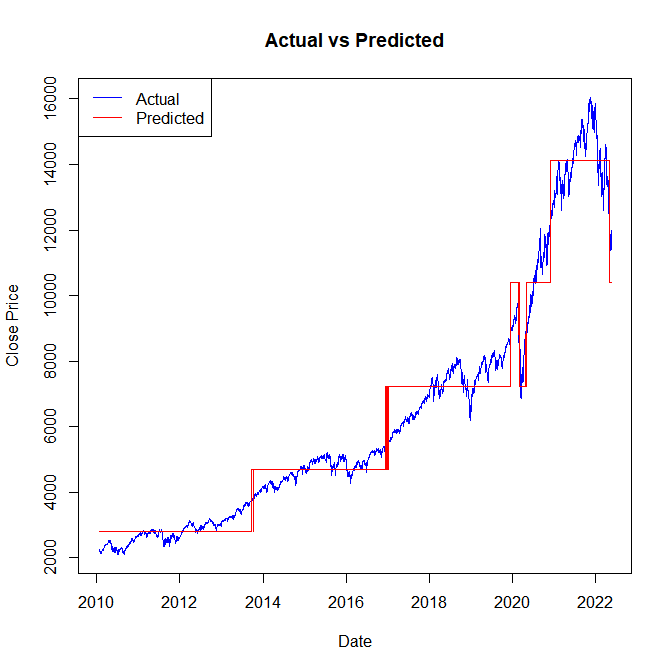

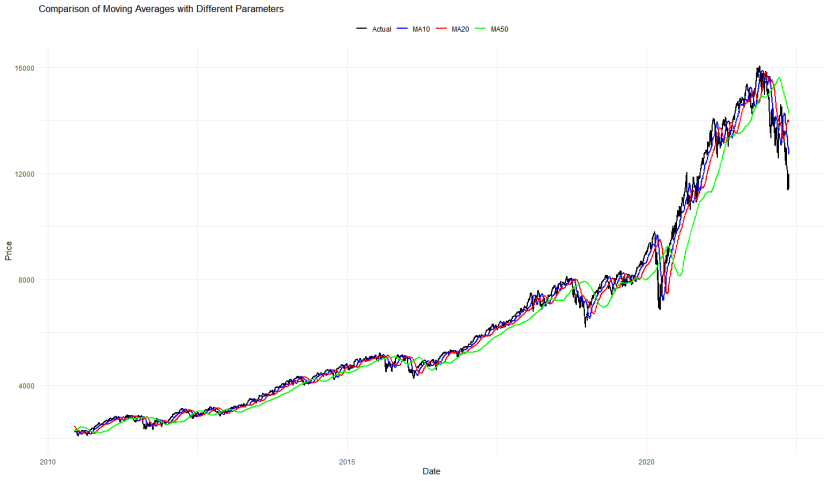

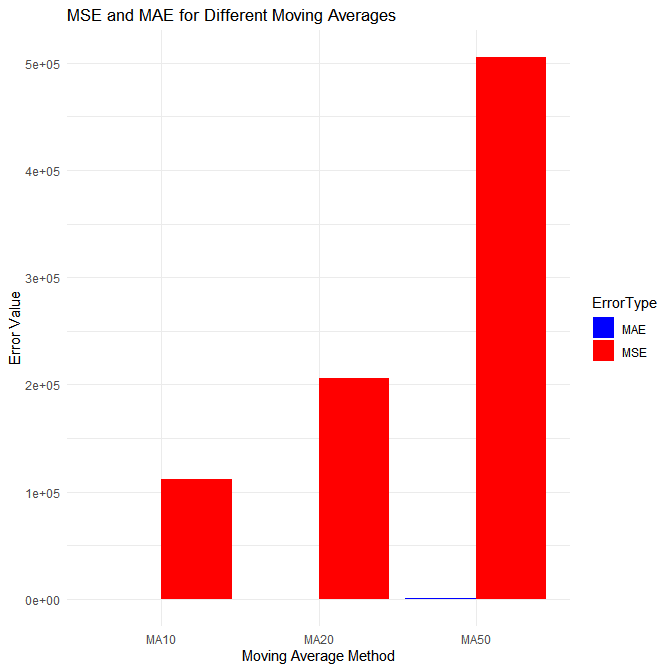

In this study, we evaluated the performance of various machine learning and time series models for predicting Nasdaq stock prices. The models used included Random Forest, Support Vector Machine (SVM), Bayesian Regression, ARIMA, Recurrent Neural Network (RNN), and Decision Tree. We assessed the models using Mean Squared Error (MSE) and Mean Absolute Error (MAE). Random Forest showed promising results with an MSE of 980.67 and an MAE of 18.46. ARIMA and Bayesian Regression exhibited higher errors, with ARIMA showing an MSE of 9763.61 and an MAE of 56.46, and Bayesian Regression with an MSE of 9937.30 and an MAE of 56.63. SVM and Decision Tree had the highest errors, with SVM at an MSE of 28651.85 and an MAE of 136.49, and Decision Tree at an MSE of 439626.21 and an MAE of 518.28. RNN excelled with the lowest errors, achieving an MSE of 4.94869e-05 and an MAE of 0.00464 on the training set, and an MSE of 7.81471e-05 and an MAE of 0.00538 on the test set. The results indicate that the proposed RNN algorithm is effective and outperforms the other models.

Show Figures

Share and Cite

Article Metrics

References

- Box, G. E. P., & Jenkins, G. M. (1976). Time Series Analysis: Forecasting and Control. Holden-Day.

- Tsay, R. S. (2005). Analysis of Financial Time Series. John Wiley & Sons.

- Gelman, A., Carlin, J. B., Stern, H. S., Dunson, D. B., Vehtari, A., & Rubin, D. B. (2013). Bayesian Data Analysis (3rd ed.). CRC Press.

- Breiman, L. (2001). Random Forests. Machine Learning, 45(1), 5-32.

- Liaw, A., & Wiener, M. (2002). Classification and Regression by randomForest. R News, 2(3), 18-22.

- Cortes, C., & Vapnik, V. (1995). Support-Vector Networks. Machine Learning, 20(3), 273-297.

- Smola, A. J., & Schölkopf, B. (2004). A tutorial on support vector regression. Statistics and Computing, 14(3), 199-222.

- Hochreiter, S., & Schmidhuber, J. (1997). Long Short-Term Memory. Neural Computation, 9(8), 1735-1780.

- Graves, A. (2012). Supervised Sequence Labelling with Recurrent Neural Networks. Springer.

- Quinlan, J. R. (1986). Induction of Decision Trees. Machine Learning, 1(1), 81-106.

- Breiman, L., Friedman, J. H., Olshen, R. A., & Stone, C. J. (1984). Classification and Regression Trees. Wadsworth.

- Zhang, G. P. (2003). Time Series Forecasting Using a Hybrid ARIMA and Neural Network Model. Neurocomputing, 50, 159-175.

- Wang, J., Wang, J., Zhang, Z., & Guo, S. (2015). Stock Index Forecasting Based on a Hybrid Model. Omega, 56, 48-61.

- Zhou, Z. H. (2012). Ensemble Methods: Foundations and Algorithms. CRC Press.

- Tseng, F. M., Yu, H. C., & Tzeng, G. H. (2002). Combining Neural Network Model with Seasonal Time Series ARIMA Model. Technological Forecasting and Social Change, 69(1), 71-87.

- LeCun, Y., Bengio, Y., & Hinton, G. (2015). Deep Learning. Nature, 521(7553), 436-444.

- Goodfellow, I., Bengio, Y., & Courville, A. (2016). Deep Learning. MIT Press.

- Li, X., & Liu, J. N. (2018). Reinforcement Learning for Portfolio Management. Journal of Finance, 73(2), 809-849.

- Sutton, R. S., & Barto, A. G. (1998). Reinforcement Learning: An Introduction. MIT Press.

- Aldridge, I. (2013). High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems. Wiley.

- Zhang, J., Li, Q., Zhang, Y., & Zhang, Y. (2016). The Impact of High-Frequency Trading on Market Quality. Journal of Financial Markets, 31, 1-22.

- Bollen, J., Mao, H., & Zeng, X. (2011). Twitter Mood Predicts the Stock Market. Journal of Computational Science, 2(1), 1-8.

- Mitra, P., & Ghosh, S. (2012). A New Approach to Forecast Stock Market Using News Sentiments. Proceedings of the 2012 IEEE/ACM International Conference on Advances in Social Networks Analysis and Mining, 14-20.

- Wang, Y., & Liu, Y. (2011). A Hybrid ARIMA and SVM Model for Stock Market Forecasting. Neural Computing and Applications, 21(1), 33-40.

- Zhang, Y., & Li, Y. (2014). Stock Market Prediction with Multiple Recurrent Neural Networks. 2014 International Joint Conference on Neural Networks (IJCNN), 2522-2527.

- Chen, K., Zhou, Y., & Dai, F. (2015). A LSTM-based Method for Stock Returns Prediction: A Case Study of China Stock Market. 2015 IEEE International Conference on Big Data, 2823-2824.

- Tang, Y., & Liao, Y. (2008). Financial Time Series Forecasting by Neural Network and Wavelet Analysis. 2008 IEEE International Conference on Granular Computing, 619-624.

- Huang, C. J., & Tsai, C. F. (2009). A Hybrid SOFM-SVR with a Filter-Based Feature Selection for Stock Market Forecasting. Expert Systems with Applications, 36(2), 1529-1538.

- Kim, K. J. (2003). Financial Time Series Forecasting Using Support Vector Machines. Neurocomputing, 55(1-2), 307-319.

- Huang, W., Nakamori, Y., & Wang, S. (2005). Forecasting Stock Market Movement Direction with Support Vector Machine. Computers & Operations Research, 32(10), 2513-2522.

- Pai, P. F., & Lin, C. S. (2005). A Hybrid ARIMA and Support Vector Machines Model in Stock Price Forecasting. Omega, 33(6), 497-505.

- Kara, Y., Boyacioglu, M. A., & Baykan, Ö. K. (2011). Predicting Direction of Stock Price Index Movement Using Artificial Neural Networks and Support Vector Machines: The Sample of the Istanbul Stock Exchange. Expert Systems with Applications, 38(5), 5311-5319.

- Sun, Y., & Cheng, Y. (2007). Research on Stock Index Prediction Based on Wavelet Neural Network Model. 2007 International Conference on Machine Learning and Cybernetics, 1675-1680.

- Lee, J., & Yoo, J. (2017). Ensemble Learning Approach for Neural Network-Based Stock Price Prediction. 2017 International Conference on Big Data and Smart Computing (BigComp), 255-260.

- Chen, K. Y., & Wang, C. H. (2007). Support Vector Regression with Genetic Algorithms in Forecasting Tourism Demand. Tourism Management, 28(1), 215-226.

- Chong, E., Han, C., & Park, F. C. (2017). Deep Learning Networks for Stock Market Analysis and Prediction: Methodology, Data Representations, and Case Studies. Expert Systems with Applications, 83, 187-205.