An open access journal

An open access journal

Research on Risks in Corporate Issuance of Green Bonds: A Case Study of Three Gorges Group

Abstract

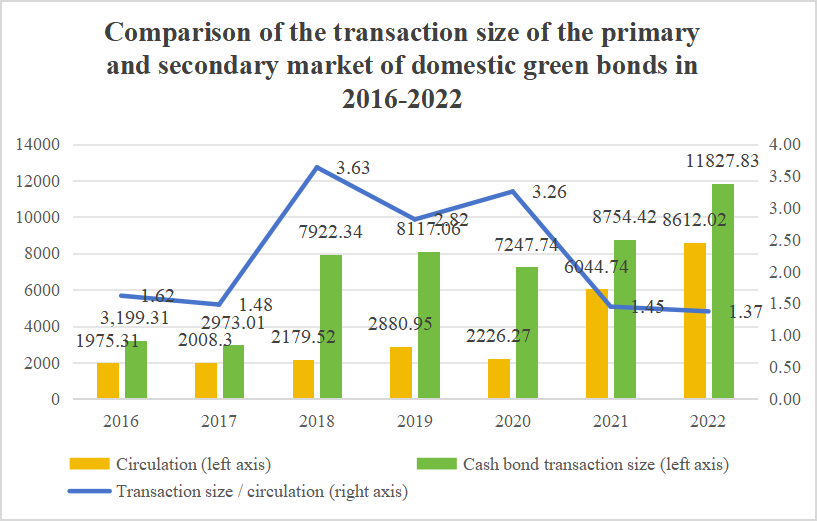

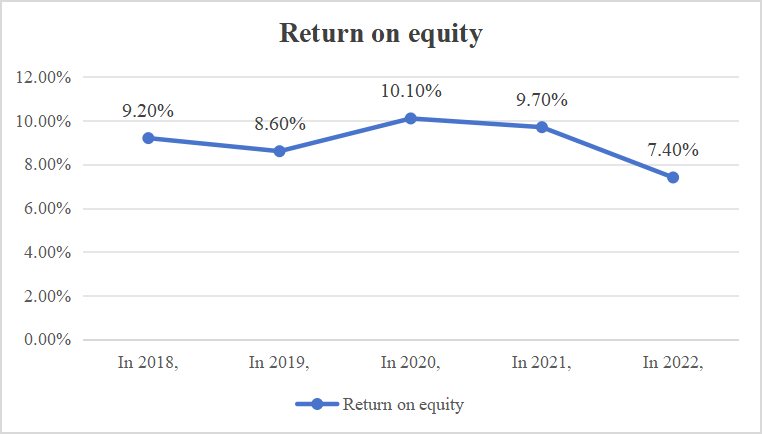

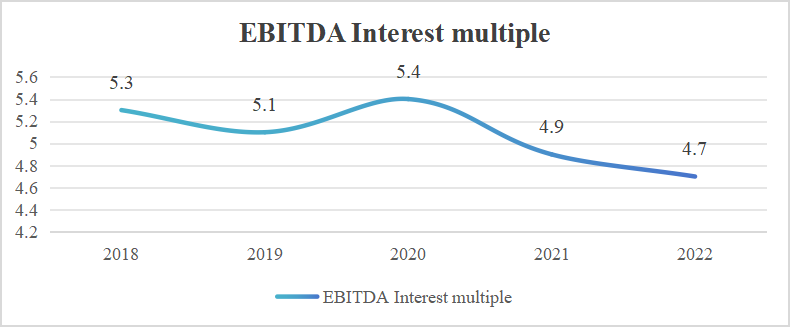

With China entering a new era of green, low-carbon, and circular development, the green economy has emerged as a powerful force driving economic transformation. Within this realm, green bonds have increasingly captured the market's attention. This paper adopts a case study approach, focusing on the Three Gorges Group's issuance of green convertible bonds. It examines the details and motivations behind the group's issuance, analyzes its short-term excess yield and long-term debt repayment, operational, and profitability capabilities. Furthermore, the study evaluates risks faced by the Three Gorges Group in issuing green bonds, including interest rate, credit, liquidity, and policy risks. Based on these findings, the paper provides recommendations and insights to guide other enterprises and investors, offering valuable experience in this field.

Show Figures

Share and Cite

Article Metrics

References

- Fang Ming, Fan Ye. Analysis of the short-term impact of equity incentive on A-share listed companies [J]. Accounting communication, 2017 (05): 41-44.

- Liang Tingxi. Study on the influencing factors of exchangeable bond default [D]. Zhongnan University of Economics and Law, 2020.

- The standard reflection and system improvement of green bonds [J]. Zhang Yixuan; Xu Yixiang. Southwest Finance, 2021 (07).

- Analysis of the factors that by stock price fluctuations when Chinese enterprises issuing green bonds [J]. Fang Wenlong; Qiu Yutian; Yang Jiale; Pang Shuolin; CAI Cenmei; Su Zhiyi; He Xingxing. Times Finance, 2021 (22).

- Wang Qi. Research on the benefits and risks of carbon-neutral bonds issued by electric power enterprises [D]. Northeast Agricultural University, 2023.

- Analysis and Suggestions on the risk of green bonds in China —— Based on the principal component analysis method [J]. He Yanming; Fu Xiaoqi; Zheng Qimin. Heilongjiang Finance, 2019 (11).

- Evaluation and progress of corporate bond credit risk pricing model [J]. Zhou Hong; Li Guoping; Lin Wanfa; Wang Yuan. Journal of Management Science, 2015 (08).

- The causes and prevention of the phenomenon of "green bleaching" in green finance: the experience and enlightenment from Japan [J]. Zhang Yue; Zhou Yingheng. Modern Japanese Economy, 2021 (05).